By Michael Ramirez, Investors Business Daily

By Michael Ramirez, Investors Business Daily

Tuesday, December 26, 2006

Saturday, December 23, 2006

Happy Christmas Eve Eve Day!

Dictionary.com defines "Eve" as:

And if I hear anyone over the age of nine refer to today as "Christmas Eve Eve" I'm just gonna smack 'em!

"the evening or the day before a holiday, church festival, or any date or event: Christmas Eve; the eve of an execution."So tomorrow could properly be referred to as "Christmas Eve" all day long. Or you could call it "the day before Christmas" or "December 24th". Just don't call it "Christmas Eve Day"! Okay?

And if I hear anyone over the age of nine refer to today as "Christmas Eve Eve" I'm just gonna smack 'em!

The week in review

- DJIA pulled back a bit this past week--down 102.30 points, 0.82% and closed Friday at 12, 343.22.

- Nasdaq Composite also lost a little ground, down 56.02 points, 2.28% and closed at 2401.18. Ouch!

- S and P 500 fell 16.33, 1.14% to close at 1410.76.

- 10-year Treasury yield rose 0.028 percentage points to 4.624%.

- Crude oil dropped $1.68/bbl 2.62% to $62.41.

Monday, December 18, 2006

Sunday, December 17, 2006

The week in review

- DJIA gained a respectable 138.03, 1.12% and closed Friday at 12,445.52.

- Nasdaq Composite also gained 19.84 points, 0.81%and stands at 2457.20.

- S and P 500 gained 17.25, 1.22%% to 1427.09.

- 10-year Treasury yield rose 0.037 percentage points to 4.597%.

- Crude oil rose $1.40, 2.26% to $63.43.

Friday, December 15, 2006

Irony

A company that built a fence to keep illegal aliens out has pleaded guilty to hiring illegal aliens. Huh?

It's not clear whether illegal aliens were involved in building the fence to keep out illegal aliens but we're guessing they were. What irony.

A Southern California fence-building company and two executives have agreed to plead guilty to knowingly hiring illegal immigrants and pay a combined penalty of $5 million, two people close to the case said Thursday, marking a rare victory for the federal government in prosecuting employers for immigration crimes.Golden State Fence Company built 6,100 feet of the 15-foot-high fence near the Otay Mesa border crossing in San Diego.

It's not clear whether illegal aliens were involved in building the fence to keep out illegal aliens but we're guessing they were. What irony.

Tuesday, December 12, 2006

Sunday, December 10, 2006

Career futures

A 19 year-old Anaheim Hills, CA student has offered up an interest in his career earnings for $100,000 rather than borrow the money to fund his college education.

In August, Steen put himself on eBay (Charts) to pay for his college education, offering 2 percent of all future earnings to the highest bidder, with a minimum $100,000 bid.He hasn't had any takers and it's no wonder. Figuring a 43 year career and a 6% discount rate, Mr. Steen would need to average better than $325,000 a year to get my interest. Good luck Ron, but that's just a little more risk than I want in my portfolio.

The week in review

- DJIA picked up 113.36 points this week, 0.93% and closed Friday at 12,307.49.

- Nasdaq Composite also gained a very healthy 24.15 points, an even 1.00% and stands at 2437.36.

- S & P 500 gained 13.13, 0.94% to 1409.84.

- 10-year Treasury yield rose 0.123 percentage points to 4.559%.

- Crude oil fell $1.40/barrel, 2.21% to $62.03.

The Happy Capitalist has been a sad and neglected blog of late as travel and professional demands have kept me away. With Christmas just a scant two weeks off, things might get worse before they get better. But these postings, as sparse as they are, help me to keep a more balanced perspective on things so they're not going to go away completely. At least not for awhile.

Wednesday, November 22, 2006

Carryon dos and don'ts for the holidays

Well, the Thanksgiving holiday begins and about a 20 million Americans will be traveling by air this long weekend. Yes, the rules about carryon luggage have been challenging to keep up with as pesky terrorists get more creative with ways to blow up airplanes. So to help ease the confusion, the Tranportation Safety Administration has posted a list of items that passengers can carry onto airplanes and those items that need to be checked or left at home.

Well, the Thanksgiving holiday begins and about a 20 million Americans will be traveling by air this long weekend. Yes, the rules about carryon luggage have been challenging to keep up with as pesky terrorists get more creative with ways to blow up airplanes. So to help ease the confusion, the Tranportation Safety Administration has posted a list of items that passengers can carry onto airplanes and those items that need to be checked or left at home.A quick look at the list reveals a few not-so-obvious items that you cannot carry onto a plane:

Ice axes/ice picks

Meat cleavers

Sabers

Swords

Bows and arrows

Spear guns

Cattle prods

Billy clubs

Brass Knuckles

Stun guns

Throwing stars

OK, so I guess it makes sense that these items can't be carried onboard, I just never thought about taking my cattle prod to Thanksgiving dinner.

If you're traveling by air this holiday season, you might want to check out TSA's list!

Tuesday, November 21, 2006

Saturday, November 18, 2006

The week in review

- DJIA shot up 234.13 this week, 1.93% and closed Friday at 12,342.56.

- Nasdaq Composite also gained a very healthy 56.14 points, 2.35% and stands at 2445.86.

- S & P 500 gained 20.30, 1.47% to 1401.20.

- 10-year Treasury yield rose slightly, 0.020 percentage points to 4.609%.

- Crude oil fell $3.78/barrel to $55.81.

- New home construction plummeted 14.6% in October to a six-year low and has many economists revising downward their estimates of U.S. economic growth. This is further evidence that the Federal Reserve, as it so often does, has overshot neutral by raising interest rates too much and too quickly.

- Nymex became a publicly traded company on Friday and debuted with the best first-day IPO performance in over a year. The stock priced at $59 and finished Friday at $132.99 after trading as high as $152 during the day.

- Rumors continue to swirl around Charles Schwab and the future of the company as its 69 year-old founder and CEO has stated that he will retire in 2007 or 2008. Some speculate that Bank of America might be involved with Schwab in talks of some sort of merger or acquisition.

Wednesday, November 15, 2006

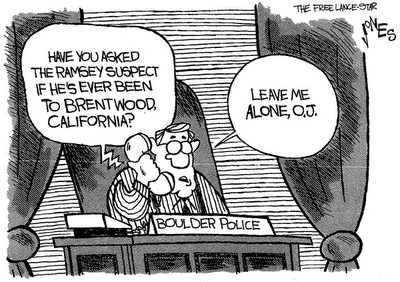

O.J., Pensions, ERISA and Golf

The following little essay was originally published on this blog on August 14th, 2005 and attempts to explain why O.J. Simpson continues to live a rather lavish lifestyle and appears not to work while the families of Nicole Brown Simpson and Ron Goldman have never received any of the judgement against Simpson. With the announcement today of his new book, If I did it, and accompanying television appearance, it seems like a good time to re-run this post.Eight years after the families of Nicole Brown Simpson and Ron Goldman won $33.5 million judgments against O. J. Simpson, many are still scratching their heads that Simpson is living lavishly while much of the award remains unpaid. How can this be?

The answer is that O. J. had some pretty smart financial advisors. During his years as an NFL star and advertising pitchman, Simpson built up hefty sums in his NFL pension and personal pensions set up through various companies he established. Then he left the money inside the defined benefit plans rather than rolling it into an IRA where he may have had more flexibility with investments. Today he draws $25,000 per month from the NFL pension alone.

The Employee Retirement Income Security Act of 1974 (ERISA) states that employer retirement plans including all types of defined benefit plans "may not be assigned or alienated." The Browns and the Goldmans can't touch O. J.'s pensions.

Despite the Simpson case, it is in society's best interest to protect retirement assets from judgments and other creditors. With an already dismal national savings rate, further discouraging participation in retirement plans wouldn't be in the country's best interest. But ERISA and the subsequent 1992 Supreme Court case, Patterson v. Shumate, extended protection only to ERISA plans. IRAs, Roth IRAs, SIMPLE IRAs, SEPs, etc. were not protected.

Finally, the courts and congress have moved to extend protection to nearly all forms of retirement accounts. On April 4th of this year the U.S. Supreme Court ruled in Rousey v. Jacoway that IRAs are "similar plans" and deserved the same sort of protection afforded to ERISA plans.

Additionally, The Bankruptcy Abuse Protection and Consumer Protection Act of 2005 (BAPCPA), signed into law on April 20, 2005, and effective on October 17, 2005, has substantially increased and simplified bankruptcy creditor protection for retirement accounts. Virtually all retirement accounts will now be exempt assets in bankruptcy proceedings.

One last word about O.J.--Simpson chooses not to work since any earned income would only be seized by the court. So he is forced to play golf every day...something's just not right.

Tuesday, November 14, 2006

Saturday, November 11, 2006

The week in review

- DJIA gained 122.39 points this week, 1.02% to 12,108.43. The rally continues.

- Nasdaq Composite picked up a healthy 58.93, 2.53, and wrapped up at 2389.72.

- S & P 500 gained 16.60, 1.22% to close the week at 1,380.90.

- 10-year Treasury yield dropped 0.127 percentage points to 4.590%.

- Crude oil rose 45 cents this week, 0.76% and stood at $59.59 yesterday afternoon.

Number one on democrats' to-do list appears to be a hike in the national minimum wage. Gee, what a compete waste of time. More than half of U.S. states already have minimum wages above the federal level and those states are discovering that employers are quick to automate, outsource, go underground and hire illegal workers or just quit business altogether rather than pay unskilled workers more than they are worth. Higher minimum wage policy creates more problems than it solves.

Democrats need to really step up to the pump and present some concrete solutions rather than a just a bunch of fluff designed to excite uninformed, unsophisticated voters. I'll be waiting.

Monday, October 30, 2006

Saturday, October 28, 2006

The week in review

- DJIA gained another 87.89 this week, 0.73% to 12,090.26. Nice little rally we've got goin'.

- Nasdaq Composite picked up 8.32, 0.36% to finish at 2,350.62.

- S & P 500 gained 8.74, 0.64% to close the week at 1,377.34.

- 10-year Treasury yield dropped 0.106 percentage points to 4.681%.

- Crude oil was up $1.42 this week, 2.39% and was up above $60 Friday at $60.75.

Tuesday, October 24, 2006

Sunday, October 22, 2006

Republicans in Berkeley?

Friday's Wall Street Journal (paid subscription) included a front-page story about the rise in conservatism on one of the nation's most liberal college campuses.

Friday's Wall Street Journal (paid subscription) included a front-page story about the rise in conservatism on one of the nation's most liberal college campuses.The growth of the Berkeley College Republicans at one of the nation's most liberal campuses echoes some broader political trends. At Berkeley, while leftist students still dominate and outnumber conservatives, the liberal groups have splintered and are now spread across factions from the Cal Democrats to the International Socialist Organization to groups formed to oppose the war in Iraq. At the same time, several faculty members say, there are more conservative-leaning students than in the past, propelled by swells of patriotic feeling after events like Sept. 11 and an increase in the number of religious student groups.While this is all very encouraging, should it really be front-page news that astute, rational thinking is taking place on a college campus?

Saturday, October 21, 2006

Week in review

- DJIA rose a respectable 41.86 points, 0.35% and closed Friday at above 12,000 at 12,00237.

- Nasdaq Composite lost 14.99 or 0.64% to finish the week at 2342.30, down 0.64%.

- S & P 500 gained a mere 2.98 points, 0.22% and closed yesterday at 1368.60

- 10-year Treasury yield fell 0.018 percentage points to finish at 4.788%.

- Crude oil dropped $1.75 to $56.82/barrel. I paid $2.44/gallon for regular yesterday, the lowest in quite a while and pretty darn good for California.

When I started my career as a stock broker with Morgan Stanley in January of 1995, the DJIA stood around 4,000. Over the course of the next few years the "thousands" fell pretty quickly. Five thousand came just before my first anniversary, 6,000, 7,000, 8000 and the rest all came pretty regularly. When the Dow reached 11,000 in the fall of 1999, there was no reason to think that 12,000 wouldn't be right around the corner. No one suspected that it would take seven years.

What's next? Well, that's anybody's guess and I doubt we'll ever experience anything like the late 90's again. But as we celebrate 12,000, I'm reminded of those days. They sure were fun.

Sunday, October 15, 2006

The week in review

- DJIA rose a respectable 110.30 points, 0.93% and closed Friday at 11,960.51. Flirtin' with 12,000.

- Nasdaq Composite 57.30 points, a really healthy 2.49% and finished off the week at 2357.29..

- S & P 500 was up 16.04 for the week, a 1.19% gain, and closed at 1365.62 Friday.

- 10-year Treasury yield increased 0.106 percentage points to 4.806%. It was a pretty lousy week for treasuries but if you're looking to refinance that ARM, 10-year Treasury yields will be under 4.50% by spring.

- Crude oil fell another $1.19 in spite of a rally Friday. Down 1.99% to $58.57.

Monday, October 09, 2006

Saturday, October 07, 2006

The week in review

- DJIA rose a health 171.14 points, 1.47% and closed Friday at 11,850.21. New records.

- Nasdaq Composite gained 41.56 points, 1.84% and finished off the week at 2299.99.

- S & P 500 was up 13.73 for the week, a 1.03% gain, and closed at 1349.58 Friday.

- 10-year Treasury yield increased 0.063 percentage points to 4.700%.

- Crude oil fell $3.15, 5.01% to $59.76.

The September jobs report was weak on the surface as new job creation was half the forecast. But the report also contained healthy upward revisions for the previous two months. The bond market paid more attention to the revisions and prices fell on Friday. It took the steam out of a nice rally in stocks as well.

Wednesday, October 04, 2006

No graffiti?

Tuesday, October 03, 2006

Saturday, September 30, 2006

The week in review

- DJIA shot up 170.97 points, 1.49% and closed Friday at 11,679.07. Smokin'!

- Nasdaq Composite gained 39.50 points, 1.78% and finished off the week at 2258.43.

- S & P 500 was up 21.07 for the week, a 1.60% gain, and closed at 1335.85 Friday.

- 10-year Treasury yield increased 0.037 percentage points to 4.637%.

- Crude oil rose $2.36, 3.90% to $62.91. A dead cat bounce?

Tuesday, September 26, 2006

Saturday, September 23, 2006

The week in review

- DJIA dropped 0.46% or 52.67 points to close out the week at 11,508.10.

- Nasdaq Composite shed 16.66 points, 0.75% and finished at 2218.93.

- S & P 500 lost just 5.09 points, 0.39% and closed Friday at 1314.78.

- 10-year Treasury yield dropped 0.198 percentage points and stands at 4.601

- Crude oil fell another $3.47, 5.42% and was trading yesterday afternoon at just $60.55/bbl.

Tuesday, September 19, 2006

Tuesday, September 12, 2006

Saturday, September 09, 2006

The week in review

- DJIA lost 72.04 this week, 0.63% and closed Friday at 11,392.11. A mild pullback.

- Nasdaq Composite shed 27.37 points, 1.25% to finish at 2165.79.

- S and P 500 was down 12.09, 0.92% and wrapped up the week at 1298.92.

- 10-year Treasury yield increased just a tad, 0.051 percentage points to 4.781%. 4.50% is till in our future. Don't refinance that ARM just yet.

- Crude oil fell another $2.94, 4.25% and stood Friday at $66.25/barrel. Wasn't it only a few weeks ago that pundits were projecting $100?

Saturday, September 02, 2006

The week in review

- DJIA gained 180.10 this week, 1.60% and closed Friday at 11,464.15. Not bad.

- Nasdaq Composite added 52.87 points, 2.47% to finish at 2133.16. Tasty.

- S and P 500 was up 15.92, 1.23% and wrapped up the week at 1311.01.

- 10-year Treasury yield dropped 0.062 percentage points to 4.728%. Is 4.50% in our future?

- Crude oil fell another $3.32, 4.58% and stood Friday at $69.19/barrel. Gee, gas will be back under 2 bucks before you know it.

Tuesday, August 22, 2006

Sunday, August 20, 2006

Saturday, August 19, 2006

The week in review

- DJIA added 293.44 this week, 2.65% and closed Friday at 11,381.47.

- Nasdaq Composite gained 106.24 points, 5.16% to finish at 2163.95.

- S and P 500 was up 35.56, 2.81% and wrapped up the week at 1302.30

- 10-year Treasury yield dropped 0.132 percentage points to 4.843%.

- Crude oil fell $3.21, 4.32% and stood Friday at $71.14/barrel.

Thursday President Bush signed into law a long-awaited pension reform bill that impacts mostly defined-benefit plans, but also adds some interesting twists for IRAs and 401(k) plans. It's great blogging material if I only had the time...

Of course the really big news this week was the (bogus) confession made by John Mark Karr to the murder of JonBenet Ramsey. The news media was sure quick to give him his 15 minutes.

Tuesday, August 15, 2006

Sunday, August 13, 2006

The week in review

- DJIA dropped 152.32 for the week, 1.36% and finished up at 11,088.03.

- Nasdaq Composite fell 27.34 points, 1.31% to 2057.71.

- S and P 500, down 12.62, 0.99% to 1266.74.

- 10-year Treasury reversed direction with the yield up 0.072 percentage points to 4.975, still hanging below 5.00!

- Crude oil fell $0.41, 0.55% to $74.35.

Friday, August 11, 2006

Word of the day

fas·cism n.

1. often Fascism

a. A system of government marked by centralization of authority under a dictator, stringent socioeconomic controls, suppression of the opposition through terror and censorship, and typically a policy of belligerent nationalism and racism.

b. A political philosophy or movement based on or advocating such a system of government.

2. Oppressive, dictatorial control.

1. often Fascism

a. A system of government marked by centralization of authority under a dictator, stringent socioeconomic controls, suppression of the opposition through terror and censorship, and typically a policy of belligerent nationalism and racism.

b. A political philosophy or movement based on or advocating such a system of government.

2. Oppressive, dictatorial control.

Tuesday, August 08, 2006

Cartoon Tuesday

Sunday, August 06, 2006

The week in review

- DJIA gained 20.65 points, 0.18% to finish the week at 11,240.35. Well, it's better than a poke in the eye with a sharp stick.

- Nasdaq Composite dropped 9.09 points, 0.43% and closed Friday at 2085.05.

- S and P 500 gained 0.81 points, 0.06% and finished at1279.36.

- 10-year Treasury yield dropped again this week, 0.093 percentage points and closed at 4.903%.

- Crude oil gained $1.52 but stayed below $75 at $74.76.

Wednesday, August 02, 2006

Liability Insurance: How much is enough?

Everyone would like to save money on auto insurance, right? Yesterday David Bach, The Automatic Millionaire, had a column on Yahoo! Finance titled "Five Ways to Slash Car Insurance Costs".

Bach's suggestions were all run-of-the-mill variety, you know, shop around, keep your driving record clean, blah, blah, blah. But one item really caught my eye.

Last year, one of our clients was at fault in an accident in which several were injured and a boy was killed. Our client, a good driver, hadn't been drinking, speeding or driving carelessly. A second of inattention, a brief error in judgement and the result was catastrophic. The victims' were awarded nearly $2 million. And this could happen to anyone. Fortunately our client carried a multi-million dollar umbrella policy, otherwise he would have been financially ruined.

So folks, just stop and think for a minute and use common sense before you take the advice of some columnist or, for that matter, some blogger. It could make a real difference.

David Bach and I both worked for Morgan Stanley in the Bay Area though we never met. Bach now lives in New York City and is making his fortune writing books and magazine articles about personal finance. I'm a CFP and now I do financial planning for high-net-worth folks in Northern California and write The Happy Capitalist. Tell me, whose got the better gig?

Bach's suggestions were all run-of-the-mill variety, you know, shop around, keep your driving record clean, blah, blah, blah. But one item really caught my eye.

Don't over-insure. Many experts suggest that liability limits of $50,000 for one person injured in an accident, $100,000 for all people injured in an accident, and $25,000 for property damage liability (called 50/100/25) is sufficient. And before you buy other add-ons such as medical coverage, check to make sure you're not just duplicating coverage you already have.Excuse me? In 21st century, lawsuit-crazy America, $100,000 in auto liability coverage is enough? I don't think so and Bach's recommendation is irresponsible. I would like to meet the "experts" he's talking to.

Last year, one of our clients was at fault in an accident in which several were injured and a boy was killed. Our client, a good driver, hadn't been drinking, speeding or driving carelessly. A second of inattention, a brief error in judgement and the result was catastrophic. The victims' were awarded nearly $2 million. And this could happen to anyone. Fortunately our client carried a multi-million dollar umbrella policy, otherwise he would have been financially ruined.

So folks, just stop and think for a minute and use common sense before you take the advice of some columnist or, for that matter, some blogger. It could make a real difference.

David Bach and I both worked for Morgan Stanley in the Bay Area though we never met. Bach now lives in New York City and is making his fortune writing books and magazine articles about personal finance. I'm a CFP and now I do financial planning for high-net-worth folks in Northern California and write The Happy Capitalist. Tell me, whose got the better gig?

Tuesday, August 01, 2006

Saturday, July 29, 2006

The week in review

- Stocks had their best week in months as the DJIA gained 353.32 points, 3.23% to close out the week at 11,219.70.

- Nasdaq Composite gained 73.75, 3.65 and finished at 2094.14.

- S and P 500 gained 38.26, 3.08% and closed Friday at 1278.55.

- 10-year Treasury yield dropped again this week, 0.051 percentage points and closed at 4.996%, the first time below 5% in months.

- Crude oil dropped another $1.19/bbl to $73.24.

Monday, July 24, 2006

Sunday, July 23, 2006

Retire on $14.5 trillion? (Reprise)

Monday's post about the $14.5 trillion Americans have stashed in retirement accounts, although not intended to be provocative, caused a bit of stir.

Rich Slick from Get Rich Slick had this to say:

Now, for a couple of fellows who seem to enjoy their calculators, might I suggest that they stop and think for a moment before punching away on the old HP12c. Both boys made three incorrect assumptions. First they assumed that the average American is never going to save another cent and will retire tomorrow. Secondly they assumed that this retirement savings won't earn anything for the next fifteen years, we're apparently just going to keep it under our mattresses. Thirdly they assumed that Americans have no other retirement savings even though the original article stated that retirement assets only account for a little over a third of household financial assets.

If Rich and Barry intended to demonstrate that Americans are woefully prepared for retirement, there's no argument. That's been documented time and time again. But I'm not worried that either of them could ever take my financial planning job. They're just not that good at the math.

Rich Slick from Get Rich Slick had this to say:

Let's do the math. $3.4 trillion divided by 80 million retiring baby boomers = $42,500/american. Average retirement 65 and lifespan 15 years (80 at death)= $2,833.33/year or $236/month.Well, Rich was using the wrong number for his calculation and Barry Ritholtz from The Big Picture called him on it.

Hmm... I don't know of anyone that can live on $236/month unless you are in some fourth world country.

Oh wait, I forgot to add all those free medicaid, medicare, prescription drug benefits everyone is going to get. Hmmm.. I wonder who's going to pay for that.

Hey Slick Rich--Barry was so enamored by the arithmetic that he published a post on his blog titled, "Do the Math"which, at last count had generated 59 comments.

Where did you get the $3.4T number? The starting point was 14.5T -- not 3.4T -- so I get $181,250 spread out over 15 years or 180 months -- Thats ~$1007.

Not much, but better than $236.

Of course, that's assuming an even distribution, which we know isn't remotely the case.

Now, for a couple of fellows who seem to enjoy their calculators, might I suggest that they stop and think for a moment before punching away on the old HP12c. Both boys made three incorrect assumptions. First they assumed that the average American is never going to save another cent and will retire tomorrow. Secondly they assumed that this retirement savings won't earn anything for the next fifteen years, we're apparently just going to keep it under our mattresses. Thirdly they assumed that Americans have no other retirement savings even though the original article stated that retirement assets only account for a little over a third of household financial assets.

If Rich and Barry intended to demonstrate that Americans are woefully prepared for retirement, there's no argument. That's been documented time and time again. But I'm not worried that either of them could ever take my financial planning job. They're just not that good at the math.

Saturday, July 22, 2006

The week in review

- DJIA finally showed a little upward movement and gained 129.03 this week, 1.2% and finished at 10,868.38.

- Nasdaq Composite dropped another 16.96 or 0.83% to wrap up the week at 2020.39.

- S and P 500 eked out a 4.09 point gain, 0.33% to finish at 1240.29.

- 10-year Treasury yield dropped again this week, 0.024 percentage points and stands at 5.047%.

- Crude oil dropped a whopping $4.28/bbl (Sept), 5.44% to $74.43. Maybe you can hang onto that big SUV a while longer.

Thursday, July 20, 2006

The web's best business blogs?

Every morning, James Altucher at The Street.com (free trial memberships available) lists some "timely, topical posts from the Web's best business blogs. " This morning, James included this post from The Happy Capitalist. Wow, I'm honored to be in such fine company!

Tuesday, July 18, 2006

Monday, July 17, 2006

Retire on $14.5 trillion?

Can we retire on $14.5 trillion? That's the amount of money Americans have stashed away in retirement accounts according to research published today by the Investment Company Institute.

Can we retire on $14.5 trillion? That's the amount of money Americans have stashed away in retirement accounts according to research published today by the Investment Company Institute. "Clearly, Americans are focused on saving for retirement as a top priority," said ICI senior economist Sarah Holden, who co-authored the study with ICI senior economist Peter Brady, in a statement.The research also showed that mutual funds' share of the retirement market continues to increase and represents about $3.4 trillion of the total.

"Our research continues to indicate that individuals are building retirement nest eggs by using employer-sponsored plans and IRAs."

Sunday, July 16, 2006

Goldman Sex?

Goldman Sachs, Goldman Sex, I suppose it could be a little confusing.

Goldman Sachs, Goldman Sex, I suppose it could be a little confusing.At least the folks at Goldman Sachs think so. They've filed a complaint against a Netherlands man who operates Goldmansex.com, an "adult entertainment guide for business travelers".

Goldman Sachs submitted the paperwork to the National Arbitration Forum this week, saying that the domain name goldmansex.com may cause confusing associations with the firm.All of the publicity generated by the legal wranglings have been the best thing that could happen to the adult entertainment site. Perhaps Goldman Sachs should offer to take the little company public.

Rob Muller, the site's founder and proprietor, chose the title because Goldman is his nickname, according to published reports.

Saturday, July 15, 2006

Week in review

Stocks don't move up in a straight line. They never have and they never will. It's always two steps forward, one step back. Sometimes that one step backward is a little hard to take, especially if it's been awhile since the last significant pullback, as is the case now. And as long as global unrest and high oil prices dominate the headlines, this market will continue to struggle.

- DJIA dropped 351.32 this past week, 3.17% to finish at 10,739.35. Pretty ugly.

- Nasdaq Composite fell 92.71 points, 4.35% this past week to finish at 2037.35.

- S & P 500 dropped 29.28 points, 2.31% and finished up at 11236.20.

- 10-year Treasury yield fell again this week and ended down 0.067 percentage points to 5.071%. It's really struggling to get very far beyond 5%.

- Oil again was the big story for the week as things are really heating up between Israel and Lebanon. Crude finished yesterday at $77.03 after having traded above $78 for awhile.

Tuesday, July 11, 2006

Monday, July 10, 2006

Hurricane Katrina--Wind or water, does it really matter?

A federal judge in Mississippi today began hearing testimony in the case of a couple whose home was damaged by Hurricane Katrina but their insurance company has paid only $1,600 for $130,000 in damage.

A federal judge in Mississippi today began hearing testimony in the case of a couple whose home was damaged by Hurricane Katrina but their insurance company has paid only $1,600 for $130,000 in damage.Now, before anyone gets worked into a lather about the big, bad insurance company stickin' it to the poor policyholder, consider this fact: Flood damage is excluded from virtually every homeowners policy. That's right, unless you buy separate flood insurance, usually through the National Flood Insurance Program, your home is not covered for flood damage.

This court case is interesting because its outcome could affect thousands of other homeowners whose homes suffered wind and water damage from Katrina. A ruling that wind caused the damage changes everything.

The trial, being heard without a jury by U.S. District Judge L. T. Senter Jr., is the first among hundreds of lawsuits that have been filed by Gulf Coast homeowners challenging insurance companies over the wind-verses-water issue. Plaintiffs' attorneys hope a ruling in the homeowners' favor would pressure insurance companies to pay out hundreds of millions of dollars in settlements for homeowners whose claims have been rejected.The homeowners also charge that their agent told them in 1999 that they didn't need flood insurance. I hope they're not really expecting the judge to believe that. Who ever heard of an insurance agent telling clients that they don't need more coverage?

Saturday, July 08, 2006

The week in review

- DJIA dropped 59.55 this past week, .53% to finish at 11,090.67. A lousy jobs report on Friday spoiled an otherwise decent week.

- Nasdaq Composite fell 42.o3 points, 1.94% this past week to finish at 2130.06.

- S & P 500 dropped 4.72 points, .37% and finished up at 1265.48.

- 10-year Treasury yield fell again this week and ended the week down 0.007 percentage points to 5.138%.

- Crude oil increased in price by another .22%, just $0.16 to $74.09/bbl. Oh yeah, Jim Rogers told Reuters that oil will soar to well over $100, although he didn't give a timetable.

Tuesday, July 04, 2006

Sunday, July 02, 2006

Capitalist of the week: Warren Buffett

With his announcement last week that he would donate $31 billion (give or take) to the Bill and Melinda Gates Foundation, Warren Buffett wins the coveted honor of Capitalist of the Week.

Born August 30th, 1930 and known as the Oracle of Omaha, Buffet is ranked as the second wealthiest person in the world behind Bill Gates. He is known for his unpretentiousness and frugality. Despite his immense wealth he still lives in the same Omaha house that he purchased in 1958 for $31,500 and draws a scant $100,000 salary from Berkshire Hathaway.

Atta boy, Warren!

Saturday, July 01, 2006

The week in review

- DJIA gained 161.13 this past week, 1.47% to finish at 11,15022, thanks to some encouraging Fed comments on Thursday.

- Nasdaq Composite picked up a healthy 50.62 points, 2.39% this past week to finish at 2172.09.

- S & P 500 gained 25.70, 2.07% and finished the week at 11270.20.

- 10-year Treasury yield fell 0.083 percentage points to end the week at 5.145%.

- Crude oil had a big week, increasing in price by 4.32%, that's $3.06 and is now around $73.93/bbl.

With overwhelming support from Berkeley residents, the Berkeley City Council unanimously passed a resolution Tuesday night to be the first jurisdiction in the United States to let the public vote for the president's impeachment. The measure will appear on the Nov. 7 ballot, at a cost of about $10,000.

Wednesday, June 28, 2006

I've been a bad, bad blogger

Geez, it's been over two weeks since my last post! And only two or three posts per week for the last several months. How did that happen?

Well, let's see. Three months ago I started a new job that's been pretty demanding and the change alone is somewhat stressful. So, longer hours and a more demanding job have been a factor. Add to that some travel. It's just hard to blog when you're away from home, even with a laptop and the wireless access that most hotels offer.

And then there was the 20th anniversary trip to Hawaii with Mrs. THC. Blog from Hawaii? C'mon, get serious.

Most recently, I spent eight days away at a Financial Planning Association program in the Midwest. I had my laptop with me but there just wasn't time to do any blogging.

Now I'm back home and things are settling down a bit. No promises, but I hope to be a bit more attentive to The Happy Capitalist. I've missed it.

Well, let's see. Three months ago I started a new job that's been pretty demanding and the change alone is somewhat stressful. So, longer hours and a more demanding job have been a factor. Add to that some travel. It's just hard to blog when you're away from home, even with a laptop and the wireless access that most hotels offer.

And then there was the 20th anniversary trip to Hawaii with Mrs. THC. Blog from Hawaii? C'mon, get serious.

Most recently, I spent eight days away at a Financial Planning Association program in the Midwest. I had my laptop with me but there just wasn't time to do any blogging.

Now I'm back home and things are settling down a bit. No promises, but I hope to be a bit more attentive to The Happy Capitalist. I've missed it.

Wednesday, June 14, 2006

Sunday, June 11, 2006

The week in review

- DJIA lost 355.95 this past week, 3.16% to finish at 10,891.92. Very ugly.

- Nasdaq Composite shed 84.35 points or 3.80% this past week to finish at 2135.06.

- S&P 500 lost 35.92, 2.79% and finished the week at 1252.30.

- 10-year Treasury yield fell 0.021 percentage points to finish at 4.979%. Below 5%, this is interesting.

- Crude oil dropped $0.70 or 0.97% to finish the week at $71.63.

- The act of surrendering or giving up. See Synonyms at surrender.

- A document containing the terms of surrender.

- An enumeration of the main parts of a subject; a summary.

Tuesday, June 06, 2006

Sunday, June 04, 2006

The week in review

- DJIA lost 30.74 for the week, 0.27% to finish at 11,247.87. That's still positive by 530 points for the year.

- Nasdaq Composite gained 9.04 or 0.41 this past week to finish at 2219.41.

- S&P 500 gained 8.06, 0.63% and finished the week at 1288.22.

- 10-year Treasury yield fell 0.052 to finish at 5.00%. Could it drop below 5%?

- Crude oil rose by $0.96 or 1.35% to finish the week at $72.33. I paid $4.29/gallon for gas on Maui last week, so the Bay Area's $3.35 doesn't seem nearly so bad.

Tuesday, May 30, 2006

Monday, May 29, 2006

Maui Sunset

Tuesday, May 23, 2006

Capitalist of the week: Dan Brown

Dan Brown, author of The Da Vinci Code is Capitalist of the Week.

Dan Brown, author of The Da Vinci Code is Capitalist of the Week.Born June 22, 1964 in Exeter, New Hampshire, Brown attended Amherst college. After graduation he dabbled in music and teaching before becoming a full-time writer in 1996. He had mediocre success with his first three novels, selling fewer than 10,000 copies in each of their first printings, but The Da Vinci Code, his fourth, went to the top of the New York Times Best Seller List during its first week in 2003 and has now sold well over 60 million copies.

In 2005 Forbes magazine estimated Brown's annual income to be about $76.5 million and his income from The Da Vinci Code to be $250 million. Brown sold the film rights for another $6 million.

Nicely done, Dan.

Saturday, May 20, 2006

Lower taxes? It'll never work!

Critics of the Bush Administration's 2001 and 2003 tax cuts said they wouldn't work. They wouldn't help pull the U.S. economy out of recession, they wouldn't generate more tax revenue, they were no more than a payoff to Bush's wealthy supporters.

Perhaps they were mistaken.

Treasury Secretary John Snow, in a speech to the Bond Market Association Friday, said: "The results are in, and they are clear: Economic growth has led to a surge of tax revenues and shrinking deficits. Despite the cries from our critics, it cannot be denied that low taxes truly are consistent with rising federal revenues, which of course help bring the deficit down."Hmmm. When you remove confiscatory taxes that are disincentives to investment and wealth creation, lo and behold, Americans invest in themselves and in U.S. business. They create more jobs, more higher paying jobs, higher corporate profits, a stronger economy and, in the long run, higher tax revenues.

It's not rocket science. It's capitalism.

The week in review

- DJIA lost 236.93 for the week, 2.08% to finish at 11,144.06. Ouch!. But just for some perspective, we finished 2005 at 10,717.50, so we're still up 4% year-to-date.

- Nasdaq Composite shed 49.90, not as bad as last week. It finished at 2193.88, down 2.22%. The Nasdaq finished 2005 at 2205, so it's showing a 0.5% loss for the year.

- S&P 500 dropped 24.21, 1.87% and finished the week at 1267.03. It closed 2005 at 1248, so it's still 1.5% on the positive side.

- 10-year Treasury yield fell 0.130 to finish at 5.062%.

- Crude oil dropped a whopping $3.51 to finish the week below $70 at $68.53. So that means gasoline should be dropping 20-30 cents/gallon, right?

Burger King priced its initial public offering on Wednesday at $17. It wasn't the best time to begin public trading but BKC fared pretty well.

The jury began deliberations this week in the Enron trial, no verdict yet. Heck, the trials only been going on 56 days.

Wednesday, May 17, 2006

Investment quiz

Tuesday, May 16, 2006

Sunday, May 14, 2006

Capitalists of the week: Herbert and Marion Sandler

In 1963 Herbert and Marion Sandler bought a California thrift for $3.8 million called Golden West Financial. They nurtured it for 43 years and this week the Oakland-based company agreed to sell itself to Wachovia Bank in a $25 billion cash and stock deal.

In 1963 Herbert and Marion Sandler bought a California thrift for $3.8 million called Golden West Financial. They nurtured it for 43 years and this week the Oakland-based company agreed to sell itself to Wachovia Bank in a $25 billion cash and stock deal.Herbert and Marion Sandler are this week's Capitalists of the Week, hands down.

Marion, 75, and Herbert, 74, share the title of co-chief executive at Golden West. Both said they believe they made the right decision to relinquish their ownership and control of Golden West.Congratulations, Herbert and Marion!

"We feel good about Wachovia," Marion Sandler said. "They are a good company. It is an amazing cultural fit. They are employee-oriented. Their benefits package is even better than ours. They understand customer service. They are very philanthropic and community-oriented."

Saturday, May 13, 2006

Only in Kalifornia

There was a time when a high school diploma indicated some level of proficiency in the three 'r's. Not anymore, at least not in California.

There was a time when a high school diploma indicated some level of proficiency in the three 'r's. Not anymore, at least not in California.On Friday, Alameda County Superior Court Judge Robert Freedman ruled that the state cannot carry out its plan to withhold diplomas from high school seniors who have not passed the state's exit exam which tests English, math and algebra skills.

State schools Superintendent Jack O'Connell said he was "greatly disappointed" and will appeal the ruling next week.Once upon a time a high school diploma actually meant something. Now it doesn't even mean that you can read and write.

"Not only is the ruling a great personal disappointment for me, it's bad news for California students who've worked hard to pass the exit exam, bad news for employers who want meaning restored to our high school diplomas and bad news for our public schools that have risen to the challenge," said O'Connell, who wrote the 1999 law that set the graduation test in motion and is its biggest champion.

The week in review

- DJIA got crushed Thursday and Friday to finish the week down 196.75, 1.70% at 11380.99

- Nasdaq Composite really got hammered to the tune of 98.79 or 4.22% and closed the week at 2243.78.

- S&P 500 lost 34.52, 2.60% to close at 1291.24

- 10-year Treasury yield rose .082 percentage points and stands at 5.192%.

- Crude oil rose $1.85 or 2.64% at $72.04

Tuesday, May 09, 2006

Monday, May 08, 2006

Capitalist of the week: Steve Wynn

Stephen Wynn, casino resort developer, is credited with spearheading the incredible expansion of Las Vegas during the 1990s.

Stephen Wynn, casino resort developer, is credited with spearheading the incredible expansion of Las Vegas during the 1990s.Born in 1942 to the owner of a string of bingo parlors on the east coast, Wynn did well enough running his father's bingo operation to buy a stake in the Frontier Hotel in Las Vegas in 1967. From there he became involved in expanding the Golden Nugget and then the Mirage. Wynn began to set the standard in Las Vegas for size and lavishness. The Wynn Las Vegas opened in 2005 and is set to open a new casino in China later this year.

According to Forbes, Wynn became a billionaire in 2004 when his net worth doubled to $1.3 billion. Stephen Wynn is truly deserving of the title "Capitalist of the Week".

(Sorry that The Happy Capitalist blog has been so neglected these last few days, but I felt the need to research this piece personally. Thanks to Mrs. THC for the photo of the Wynn Resort).

Subscribe to:

Comments (Atom)