A recent poll by the Roper Center for Public Opinion Research reported that the average American family spent $1.22 last year for each dollar it earned and 1.6 million Americans filed for bankruptcy.

According to U.S. News and World Report, 25% of workers age 45-54 have less than $25,000 saved for retirement.

Cardweb.com reports that in 2004, average household credit card debt rose to $9,312 from $7,842 in 2000.

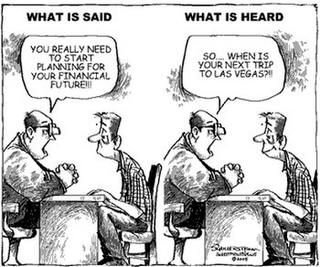

These figures accurately point out that many Americans are financially illiterate. And this concern looms even larger when you consider that we are being asked to take on more and more personal responsibility through tougher bankruptcy laws, consumer-driven health insurance plans, possible Social Security reform and the shift from guaranteed pension plans to defined contribution plans.

An editorial in InvestmentNews suggests that these problems would improve if financial literacy could be raised. While schools have begun to take on this task, they have not embraced it wholeheartedly. It is up to the financial services industry to raise consumers' awareness and help people understand the steps they need to take for their own financial well-being. It's going to take a great deal of hard work.

No comments:

Post a Comment