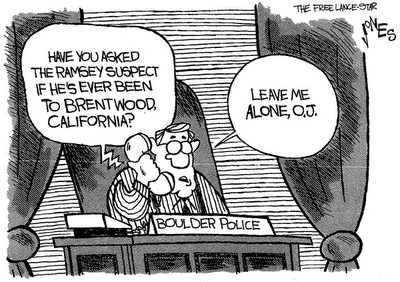

Clay Jones, The Freelance-Star, Fredericksburg, VA

Clay Jones, The Freelance-Star, Fredericksburg, VATuesday, August 22, 2006

Sunday, August 20, 2006

Saturday, August 19, 2006

The week in review

- DJIA added 293.44 this week, 2.65% and closed Friday at 11,381.47.

- Nasdaq Composite gained 106.24 points, 5.16% to finish at 2163.95.

- S and P 500 was up 35.56, 2.81% and wrapped up the week at 1302.30

- 10-year Treasury yield dropped 0.132 percentage points to 4.843%.

- Crude oil fell $3.21, 4.32% and stood Friday at $71.14/barrel.

Thursday President Bush signed into law a long-awaited pension reform bill that impacts mostly defined-benefit plans, but also adds some interesting twists for IRAs and 401(k) plans. It's great blogging material if I only had the time...

Of course the really big news this week was the (bogus) confession made by John Mark Karr to the murder of JonBenet Ramsey. The news media was sure quick to give him his 15 minutes.

Tuesday, August 15, 2006

Sunday, August 13, 2006

The week in review

- DJIA dropped 152.32 for the week, 1.36% and finished up at 11,088.03.

- Nasdaq Composite fell 27.34 points, 1.31% to 2057.71.

- S and P 500, down 12.62, 0.99% to 1266.74.

- 10-year Treasury reversed direction with the yield up 0.072 percentage points to 4.975, still hanging below 5.00!

- Crude oil fell $0.41, 0.55% to $74.35.

Friday, August 11, 2006

Word of the day

fas·cism n.

1. often Fascism

a. A system of government marked by centralization of authority under a dictator, stringent socioeconomic controls, suppression of the opposition through terror and censorship, and typically a policy of belligerent nationalism and racism.

b. A political philosophy or movement based on or advocating such a system of government.

2. Oppressive, dictatorial control.

1. often Fascism

a. A system of government marked by centralization of authority under a dictator, stringent socioeconomic controls, suppression of the opposition through terror and censorship, and typically a policy of belligerent nationalism and racism.

b. A political philosophy or movement based on or advocating such a system of government.

2. Oppressive, dictatorial control.

Tuesday, August 08, 2006

Cartoon Tuesday

Sunday, August 06, 2006

The week in review

- DJIA gained 20.65 points, 0.18% to finish the week at 11,240.35. Well, it's better than a poke in the eye with a sharp stick.

- Nasdaq Composite dropped 9.09 points, 0.43% and closed Friday at 2085.05.

- S and P 500 gained 0.81 points, 0.06% and finished at1279.36.

- 10-year Treasury yield dropped again this week, 0.093 percentage points and closed at 4.903%.

- Crude oil gained $1.52 but stayed below $75 at $74.76.

Wednesday, August 02, 2006

Liability Insurance: How much is enough?

Everyone would like to save money on auto insurance, right? Yesterday David Bach, The Automatic Millionaire, had a column on Yahoo! Finance titled "Five Ways to Slash Car Insurance Costs".

Bach's suggestions were all run-of-the-mill variety, you know, shop around, keep your driving record clean, blah, blah, blah. But one item really caught my eye.

Last year, one of our clients was at fault in an accident in which several were injured and a boy was killed. Our client, a good driver, hadn't been drinking, speeding or driving carelessly. A second of inattention, a brief error in judgement and the result was catastrophic. The victims' were awarded nearly $2 million. And this could happen to anyone. Fortunately our client carried a multi-million dollar umbrella policy, otherwise he would have been financially ruined.

So folks, just stop and think for a minute and use common sense before you take the advice of some columnist or, for that matter, some blogger. It could make a real difference.

David Bach and I both worked for Morgan Stanley in the Bay Area though we never met. Bach now lives in New York City and is making his fortune writing books and magazine articles about personal finance. I'm a CFP and now I do financial planning for high-net-worth folks in Northern California and write The Happy Capitalist. Tell me, whose got the better gig?

Bach's suggestions were all run-of-the-mill variety, you know, shop around, keep your driving record clean, blah, blah, blah. But one item really caught my eye.

Don't over-insure. Many experts suggest that liability limits of $50,000 for one person injured in an accident, $100,000 for all people injured in an accident, and $25,000 for property damage liability (called 50/100/25) is sufficient. And before you buy other add-ons such as medical coverage, check to make sure you're not just duplicating coverage you already have.Excuse me? In 21st century, lawsuit-crazy America, $100,000 in auto liability coverage is enough? I don't think so and Bach's recommendation is irresponsible. I would like to meet the "experts" he's talking to.

Last year, one of our clients was at fault in an accident in which several were injured and a boy was killed. Our client, a good driver, hadn't been drinking, speeding or driving carelessly. A second of inattention, a brief error in judgement and the result was catastrophic. The victims' were awarded nearly $2 million. And this could happen to anyone. Fortunately our client carried a multi-million dollar umbrella policy, otherwise he would have been financially ruined.

So folks, just stop and think for a minute and use common sense before you take the advice of some columnist or, for that matter, some blogger. It could make a real difference.

David Bach and I both worked for Morgan Stanley in the Bay Area though we never met. Bach now lives in New York City and is making his fortune writing books and magazine articles about personal finance. I'm a CFP and now I do financial planning for high-net-worth folks in Northern California and write The Happy Capitalist. Tell me, whose got the better gig?

Tuesday, August 01, 2006

Subscribe to:

Comments (Atom)